Navigating the landscape of Environmental, Social, and Governance (ESG) considerations has never been more crucial for corporate entities. The demands from stakeholders can be intricate, leaving companies in search of clear guidance on governance, management, and disclosure of ESG matters.

Delve into key highlights such as:

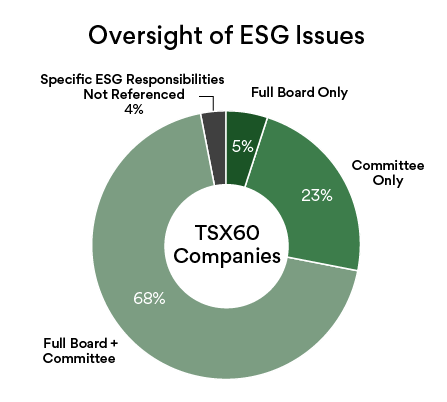

- Board Oversight: Boards taking a more active role in ESG oversight, with increasing involvement from audit committees.

- Executive Compensation: ESG metrics impact short-term compensation decisions, with more companies building specific ESG metrics applicable to these decisions. A number of companies are also reporting on "wage gap" ratios.

- Reporting Frameworks: Sustainability reports are becoming a key tool for ESG disclosure, with companies referencing one or more frameworks for their reporting.

- Assurance: Companies are increasingly obtaining third-party assurance (typically limited assurance) for specific ESG disclosures.

- Forced and/or Child Labour: Companies express zero tolerance for forced and/or child labor in their supply chains, but most companies have not yet proactively disclosed against the FCLA disclosure requirements in effect this year.

- Targets: More corporations are disclosing an absolute GHG emissions reduction target.

- Shareholder Proposals: The financial services industry receives the most ESG-related proposals. Often proposals related to governance issues are settled before being put to vote at shareholder meetings.

- Indigenous Engagement: Natural resource sectors and financial services lead in disclosing formal policies for Indigenous reconciliation.

The Study also probes into other crucial ESG governance considerations, illuminating how boards and committees allocate oversight of ESG-related matters.

Special Acknowledgement to Articling Students Barbara Clark, Shazad Omarali, and Isabelle Savoie for their contribution. Additional contributors include Articling Students Katlin Abrahamson, Amir Alavi, Tara Bishop, Latoya Brown, Jonathan Duforest, and Allan Prest.

For more information or to discuss specific matters, our dedicated team is ready to assist you.